As an Amazon Associate, I earn from qualifying purchases.

Thinking about tapping into your home’s value? You might be wondering, “Is it smart to take out a home equity loan?”

This decision could unlock cash for big expenses, like home improvements or debt consolidation. But is it really the right move for you? Before you dive in, it’s crucial to understand how these loans work and what risks and benefits they carry.

Keep reading, and you’ll discover clear answers that can help you make the smartest choice for your financial future.

:max_bytes(150000):strip_icc()/homeequityloan-e11896bf4ac1475a9806a55f92e0c312.jpg)

Credit: www.investopedia.com

Home Equity Loan Basics

Home equity loans let you borrow money using your home’s value. It is a way to access cash for big expenses like repairs or debt.

The amount you can borrow depends on how much your home is worth and what you owe on it. Understanding the basics helps you decide if this loan suits your needs.

What Is A Home Equity Loan

A home equity loan is a loan secured by your home’s equity. You get a lump sum of money. Then, you pay it back with fixed monthly payments over time.

The interest rate is usually lower than other loans because your home is collateral. This loan is a second mortgage on your property.

How It Differs From Other Loans

Unlike personal loans, home equity loans use your home as security. This often means lower interest rates and longer repayment periods.

Home equity loans differ from home equity lines of credit (HELOCs). HELOCs let you borrow as you need, but home equity loans give a fixed amount upfront.

The steady payments and fixed rates offer predictability. This can help with budgeting your finances better.

Credit: www.itcu.org

Benefits Of Home Equity Loans

Home equity loans offer many advantages for homeowners. They allow you to borrow against the value of your home. This can help manage larger expenses without selling your property. Knowing the benefits can help you decide if this loan fits your needs.

These loans often come with lower interest rates than other types of credit. They also provide tax benefits and the freedom to use funds in many ways. Let’s explore these benefits in detail.

Lower Interest Rates

Home equity loans usually have lower interest rates than credit cards or personal loans. This means you pay less money in interest over time. Lower rates make it easier to afford monthly payments. This benefit helps save money while borrowing.

Tax Advantages

Interest paid on home equity loans may be tax-deductible. This depends on how you use the loan funds. Using the loan for home improvements often qualifies for tax breaks. This can lower your overall tax bill and reduce loan costs.

Flexible Use Of Funds

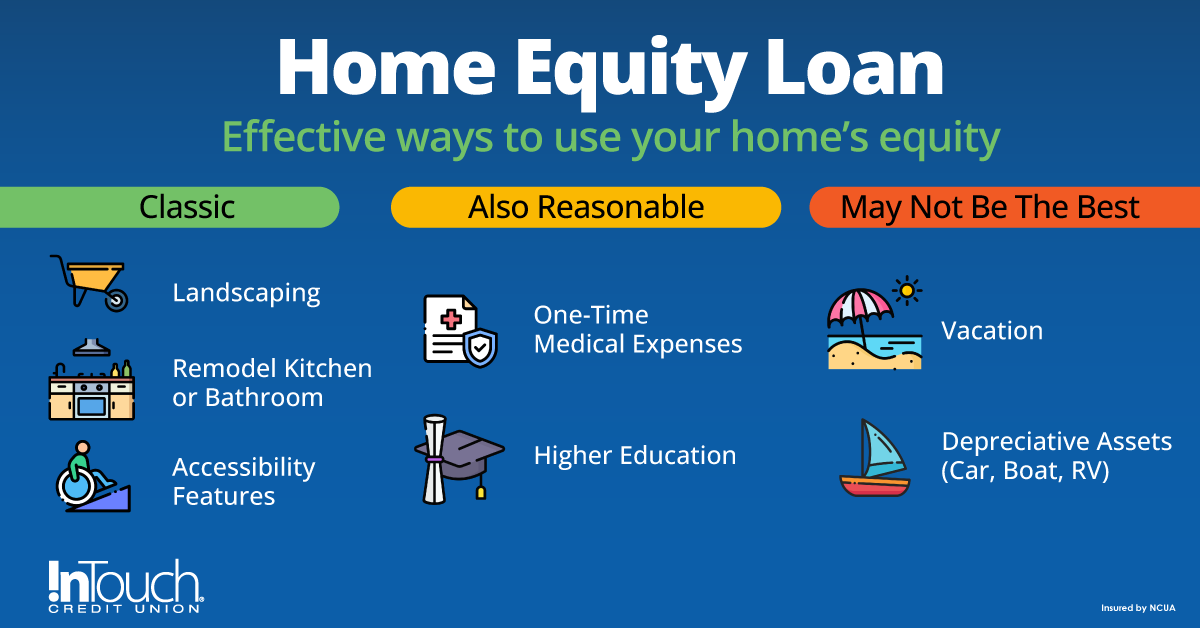

Home equity loans allow you to use money for many purposes. You can pay for home repairs, education, or medical bills. Some people use them to consolidate higher-interest debt. This flexibility makes these loans useful for various financial needs.

Risks And Drawbacks

Taking out a home equity loan offers benefits, but it also has risks. These risks can affect your finances and your home. Knowing these drawbacks helps you make better choices.

Impact On Home Ownership

A home equity loan uses your house as security. Failing to repay can lead to losing your home. This risk makes it important to consider your ability to pay back.

Borrowing reduces the equity you have in your house. This limits your options if you want to sell or refinance later. Lower equity might also affect your credit score.

Potential For Debt Cycle

Taking one loan to pay another can start a debt cycle. This happens if you borrow more to cover payments. The debt grows, making it harder to get out.

High monthly payments strain your budget. Missing payments increases fees and interest. This can worsen financial troubles over time.

Market Fluctuations

Home values can go down as well as up. If the market drops, your home’s worth may fall below the loan amount. This situation leaves you owing more than your home is worth.

Market changes affect your ability to refinance or sell. It can limit your financial flexibility and increase stress.

Credit: www.citizensbank.com

When To Consider A Home Equity Loan

Deciding to take out a home equity loan can be a smart choice in specific situations. It lets you borrow against the value of your home. This type of loan offers lower interest rates than many other loans. It is important to use it for the right reasons. Using a home equity loan wisely can save money and reduce stress.

Major Home Improvements

Home equity loans work well for big home repairs or upgrades. Projects like a new roof, kitchen remodel, or adding a bathroom are good examples. These improvements can raise your home’s value. Using a home equity loan can help cover these costs. It spreads payments over time, making large expenses easier to manage.

Debt Consolidation

Many use home equity loans to pay off high-interest debts. Credit cards and personal loans often have high rates. A home equity loan usually has a lower interest rate. Paying off multiple debts with one loan simplifies finances. It also reduces the total interest paid over time.

Emergency Expenses

Unexpected expenses can be tough to handle. Medical bills, urgent home repairs, or other emergencies need quick funds. A home equity loan can provide needed cash fast. It offers a lower cost borrowing option in tough times. This loan should be used carefully during emergencies to avoid future financial problems.

Alternatives To Home Equity Loans

Home equity loans are one way to borrow money using your home’s value. There are other options to consider. These alternatives may suit your needs better. They often have different costs and risks. Understanding these choices helps you pick the best option for your situation.

Explore personal loans, cash-out refinance, and credit cards as alternatives. Each has unique features and requirements. Learn about them to make an informed decision.

Personal Loans

Personal loans do not use your home as collateral. They are usually faster to get than home equity loans. Interest rates may be higher, but approval is simpler. You borrow a fixed amount and pay it back in fixed monthly payments. These loans work well for small to medium expenses.

Cash-out Refinance

Cash-out refinance replaces your current mortgage with a larger loan. You get the difference in cash to use freely. This option can have lower interest rates than personal loans or credit cards. It spreads payments over many years. Good for large expenses or debt consolidation.

Credit Cards

Credit cards offer quick access to money for smaller needs. They have high interest rates if balances are not paid in full. Some cards have 0% interest for a limited time. Use credit cards carefully to avoid high debt. Best for short-term borrowing or emergencies.

Expert Tips For Borrowers

Taking out a home equity loan can be a good choice for some borrowers. It offers access to cash using your home’s value. Before making a decision, use expert tips to guide you. These tips help you avoid common mistakes and manage your money wisely.

Assessing Your Financial Situation

Check your current income and expenses carefully. Know how much debt you already have. Think about your job stability and future earnings. Be honest about your ability to make loan payments. This step helps prevent financial stress later.

Comparing Loan Offers

Look at interest rates from several lenders. Understand the fees and charges involved. Note the loan terms and length. Choose the offer that fits your budget and goals. Small differences can save you a lot of money.

Planning For Repayment

Create a clear plan to pay back the loan. Set a monthly budget including your loan payment. Consider what happens if your income changes. Avoid borrowing more than you can repay. A strong plan keeps your finances safe.

Frequently Asked Questions

What Is A Home Equity Loan And How Does It Work?

A home equity loan lets you borrow against your home’s value. You get a lump sum and repay with fixed interest. It uses your home as collateral, making it a secured loan with potentially lower rates than unsecured loans.

When Is Taking A Home Equity Loan A Smart Choice?

It’s smart when you need large funds for home improvement or debt consolidation. Interest rates are usually lower, and interest may be tax-deductible. Avoid if you can’t afford monthly payments or risk losing your home.

What Are The Risks Of A Home Equity Loan?

The main risk is losing your home if you default. Interest rates might rise if you choose variable rates. Also, borrowing too much can reduce your home’s equity and financial flexibility.

How Does A Home Equity Loan Compare To A Heloc?

A home equity loan provides a lump sum with fixed payments. HELOC offers a credit line with variable rates and flexible withdrawals. Choose based on your spending needs and payment preference.

Conclusion

Taking out a home equity loan can offer extra cash when needed. It helps pay for big expenses like repairs or education. But it also means using your home as loan security. This can bring risks if you miss payments.

Think about your budget and future plans first. Compare rates and terms from different lenders. Ask questions and read all the fine print carefully. This way, you can decide if a home equity loan fits your needs. Wise choices lead to better financial health.

As an Amazon Associate, I earn from qualifying purchases.