As an Amazon Associate, I earn from qualifying purchases.

Are you unsure how to calculate leave loading and what it means for your pay? Understanding leave loading can save you money and help you plan your time off better.

You’ll discover exactly how leave loading works, why it matters, and the simple steps you can follow to calculate it correctly. By the end, you’ll feel confident managing your leave entitlements and making the most of your hard-earned benefits. Keep reading to unlock the secrets behind leave loading and take control of your pay!

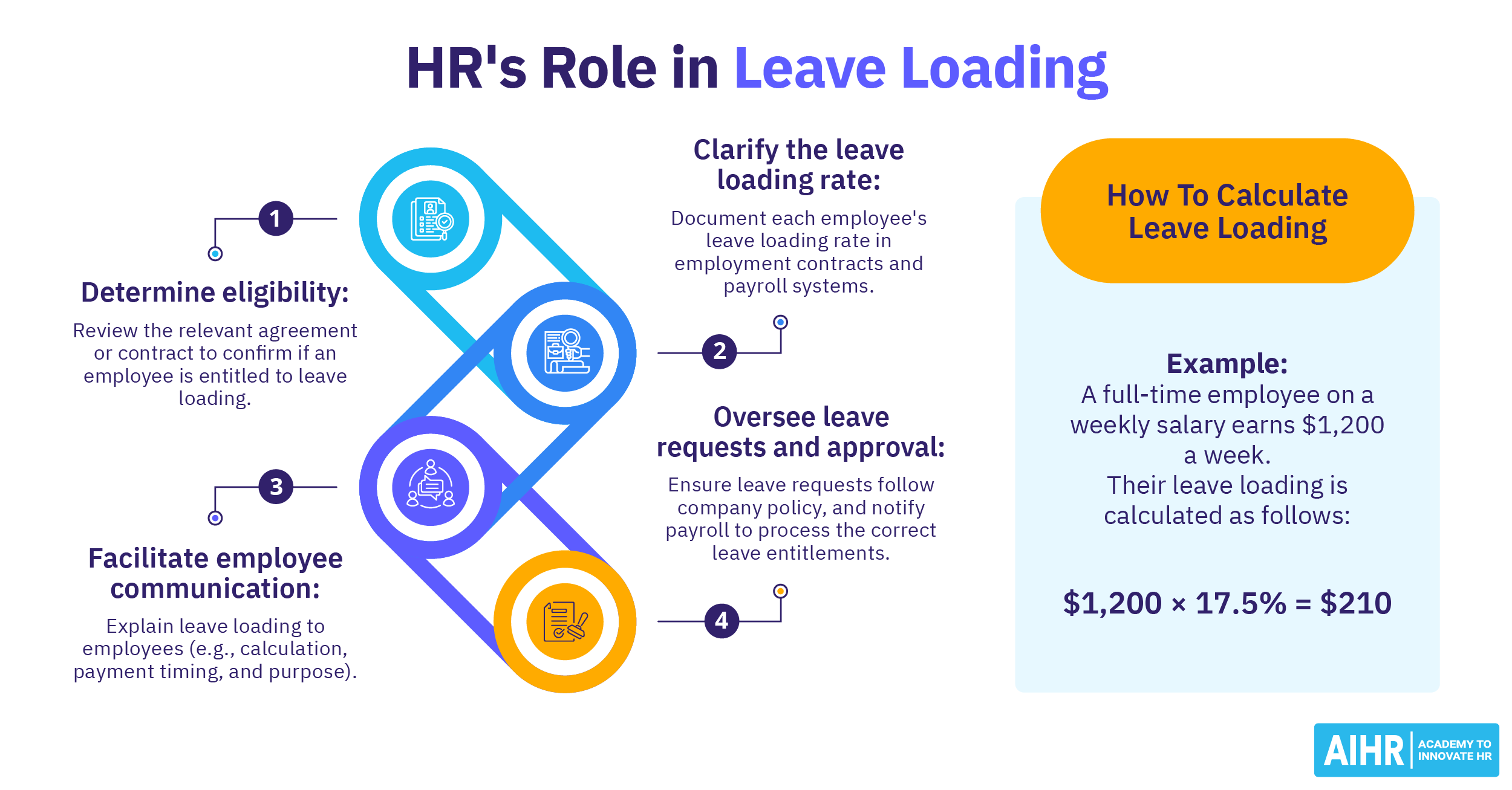

Credit: www.aihr.com

What Is Leave Loading

Leave loading is a payment benefit paid to employees during their annual leave. It is an extra amount on top of the usual leave pay. This extra payment helps cover the costs employees might face while on leave.

Many employers include leave loading in their contracts or agreements. The purpose is to give workers extra financial support while they rest. Understanding leave loading helps employees know their rights and what to expect during leave.

What Does Leave Loading Mean?

Leave loading means extra pay during annual leave. It is usually a percentage of the normal wage. This payment compensates for lost opportunities to earn bonuses or overtime.

Who Gets Leave Loading?

Not all employees receive leave loading. It depends on the workplace agreement or award. Some industries or jobs include it by law or contract.

Why Is Leave Loading Paid?

Leave loading helps employees cover extra costs during leave. It supports workers to enjoy their break without financial worry. It also rewards employees for their hard work.

Credit: www.aihr.com

Who Qualifies For Leave Loading

Leave loading is an extra payment made to employees during their annual leave. It helps cover costs employees might face while taking time off. Not every worker gets leave loading. Rules decide who qualifies for it.

Understanding who qualifies for leave loading is important. It ensures employees know their rights and employers follow the law. The eligibility depends on the type of employment and the award or agreement that applies.

Full-time And Part-time Employees

Most full-time employees qualify for leave loading. Part-time workers may also get it if their contract or award includes this benefit. The payment is usually a percentage of their normal pay.

Casual Employees

Casual employees usually do not receive leave loading. They get a higher hourly rate instead of paid leave. This rate often covers the leave loading component.

Employees Covered By Awards Or Agreements

Leave loading depends on the award or enterprise agreement. Some awards require leave loading payments. Others do not. Check the specific agreement to know if leave loading applies.

New Employees

New employees may not qualify immediately. Some awards require a minimum employment period before leave loading applies. This period varies by award or agreement.

Employees On Leave Without Pay

Employees on unpaid leave do not get leave loading. The payment is tied to paid annual leave only. Only time spent on paid leave counts.

Common Leave Loading Rates

Common leave loading rates vary depending on the country and employer policies. Understanding these rates helps employees know how much extra pay they get during leave. Leave loading is often a percentage added to the base pay during annual leave.

The most typical leave loading rate is 17.5%. This rate is common in Australia and applies to many workers under awards or agreements. Some employers may use different rates based on contracts or local laws.

Standard Leave Loading Rate Of 17.5%

The 17.5% rate means employees receive an extra 17.5% of their normal pay during leave. For example, if the regular pay is $1000, the leave pay becomes $1175. This extra pay helps cover additional costs during time off.

Different Rates In Various Industries

Some industries have special leave loading rates. For example, construction or mining jobs might have higher rates. These rates reflect the nature of the work and industry agreements.

Leave Loading Rates In Other Countries

Not all countries use the 17.5% rate. Some have no leave loading at all. Others might add a flat amount or a smaller percentage. Always check local laws and company policies for accurate rates.

Step-by-step Calculation Process

Calculating leave loading is a straightforward process. It helps employees know how much extra pay they get during leave. Follow these clear steps to find the correct leave loading amount. Each step focuses on one part of the calculation.

Gather Relevant Pay Details

Start by collecting your basic pay rate. This usually means your weekly or hourly wage. Also, find any allowances or bonuses that count toward leave pay. Check your pay slips or employment contract for accuracy.

Determine Applicable Leave Period

Identify the length of your leave in days or weeks. This time frame shows how much leave pay you should calculate. Make sure the leave period matches the pay details you gathered earlier.

Calculate Base Leave Pay

Multiply your basic pay by the number of leave days. This gives you the base amount of leave pay. Use the same units, like days or weeks, in your calculation for precision.

Apply Leave Loading Rate

Find out the leave loading percentage set by your employer or law. Usually, it is 17.5% of the base leave pay. Multiply the base leave pay by this rate to get the loading amount.

Verify Total Leave Loading Amount

Add the base leave pay and the leave loading amount. This total shows the full pay you will receive during leave. Double-check your numbers to avoid mistakes. Keep a record of your calculation for future reference.

Examples Of Leave Loading Calculations

Understanding how to calculate leave loading helps employees and employers manage leave payments fairly. Leave loading is an extra payment on top of the usual pay during annual leave. It usually adds 17.5% to the normal pay rate. Below are simple examples showing how leave loading is calculated for different types of employees.

Full-time Employee Scenario

A full-time employee earns $800 per week. Leave loading is 17.5% of this amount. Multiply $800 by 0.175 to get $140. The total leave pay is $800 plus $140, which equals $940. The employee receives $940 for one week of annual leave.

Part-time Employee Scenario

A part-time employee works 20 hours a week and earns $20 per hour. Weekly pay is 20 hours times $20, which is $400. Calculate 17.5% leave loading on $400. That is $400 times 0.175, equal to $70. Total leave payment is $400 plus $70, or $470 for a week’s leave.

Casual Employee Scenario

A casual employee earns $25 per hour with a 25% casual loading already included. For 38 hours of work, pay is 38 times $25, or $950. Casual employees do not usually get leave loading. So, leave pay remains $950 for one week of leave.

Credit: www.youtube.com

Factors Affecting Leave Loading

Leave loading is an extra payment on top of your usual pay during annual leave. Several factors affect how leave loading is calculated. Understanding these factors helps ensure you get the correct amount. Let’s explore the main elements that influence leave loading.

Award And Agreement Variations

Different jobs have different rules for leave loading. These rules come from awards or workplace agreements. Some awards say you get 17.5% leave loading. Others might set a different rate or no loading at all. Always check your specific award or agreement. This will tell you if you get leave loading and how much.

Public Holidays During Leave

Public holidays can change your leave loading. If a public holiday falls during your leave, you usually do not get leave loading for that day. The holiday is paid separately. This means your loading only applies to actual leave days. Counting public holidays right keeps your pay accurate.

Unpaid Leave Periods

Unpaid leave affects leave loading too. If you take unpaid leave before or during your annual leave, it may reduce your leave loading. This happens because leave loading is based on paid work periods. Unpaid time lowers the base pay for calculating loading. Knowing this helps avoid surprises in your pay.

Common Mistakes To Avoid

Calculating leave loading can be tricky. Many make mistakes that cost time and money. Avoid these common errors to get your calculations right. Check your work carefully and understand the rules.

Misapplying The Loading Rate

Using the wrong loading rate is a frequent mistake. Some apply 17.5% without checking the exact rate required. The rate can vary by industry or agreement. Always confirm the correct percentage before calculating.

Incorrect Pay Period Selection

Choosing the wrong pay period can change your leave loading amount. Some use weekly pay instead of the correct fortnightly or monthly pay. Match the pay period to your payroll cycle for accurate results.

Ignoring Employment Agreements

Employment agreements often have specific leave loading terms. Ignoring these agreements leads to errors in calculations. Always review contracts or awards to ensure compliance. This protects both employer and employee rights.

Tools And Resources For Accurate Calculation

Calculating leave loading can be tricky without the right help. Using proper tools and resources makes the process easier and more accurate. These tools help avoid mistakes and save time. They also ensure compliance with laws and company policies.

Payroll Software Features

Payroll software often includes leave loading calculators. These tools automate calculations based on employee data. They reduce errors and speed up payroll processing. Many programs update automatically to match current laws. Some also generate reports for easy review.

Government Guidelines

Government websites provide clear rules on leave loading. They explain how to calculate rates and what applies. These guidelines help ensure legal compliance. Checking them regularly keeps calculations up to date. Official sources are the best place for accurate information.

Consulting Hr Professionals

HR experts understand leave loading rules well. They offer advice tailored to your company’s needs. Consulting them helps resolve complex situations. They can guide on policy creation and updates. HR professionals are valuable resources for accurate calculations.

Frequently Asked Questions

What Is Leave Loading And Why Calculate It?

Leave loading is an extra payment on annual leave. It compensates employees for lost overtime or penalty rates. Calculating it ensures fair pay during leave periods and complies with employment laws.

How Do You Calculate Leave Loading Percentage?

Leave loading is usually calculated at 17. 5% of the base pay. Multiply your ordinary hourly rate by 17. 5% and then by the leave hours taken. This gives the leave loading amount.

Which Pay Rates Include Leave Loading Calculation?

Leave loading applies to base salary or ordinary hourly rates only. Overtime, bonuses, or penalty rates are excluded. This ensures fair compensation during annual leave without inflating payments.

When Is Leave Loading Paid To Employees?

Leave loading is paid when employees take annual leave. It is included with the regular leave pay. Some awards or agreements specify exact timing for leave loading payments.

Conclusion

Calculating leave loading helps ensure fair pay during leave periods. It adds a percentage to your regular wage for annual leave. This extra pay supports your usual income while you rest. Knowing how to calculate it makes managing your finances easier.

Always check your employment agreement for the exact rate. Keep track of your leave and payments carefully. This way, you avoid surprises when taking time off. Understanding leave loading keeps your work benefits clear and simple.

As an Amazon Associate, I earn from qualifying purchases.